are funeral expenses tax deductible in ontario

The IRS does not levy taxes on most estates so only the most prosperous can benefit from tax deductions on their funeral expenses. Funeral expenses that are NOT tax-deductible are any which are not paid by the deceased persons estate.

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

One way is to file a return early.

. Funeral expenses paid by your estate including. First month and security deposit paid upfront. If your estate in NC will be worth more than 1206 million after you pass away you may want to look for tax deductions for your estate.

Another way to get a tax break is to use the EITC. This could affect whether or not youre able to deduct the cost. Monthly payments may be tax.

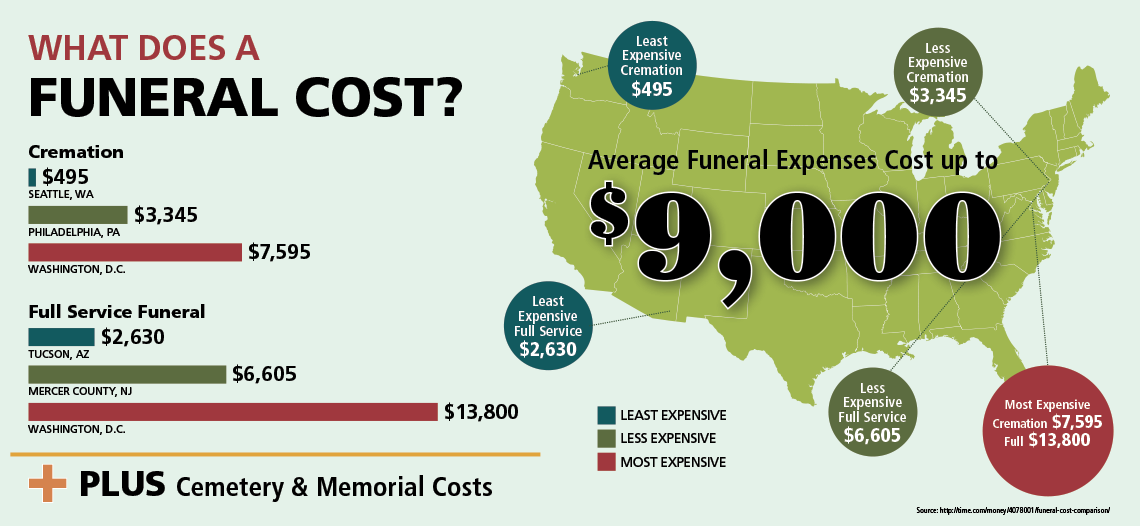

When Funeral and Cremation Expenses are NOT Tax-Deductible. Individual taxpayers cannot deduct funeral expenses from their tax return. Individual taxpayers cannot deduct funeral expenses on their tax return.

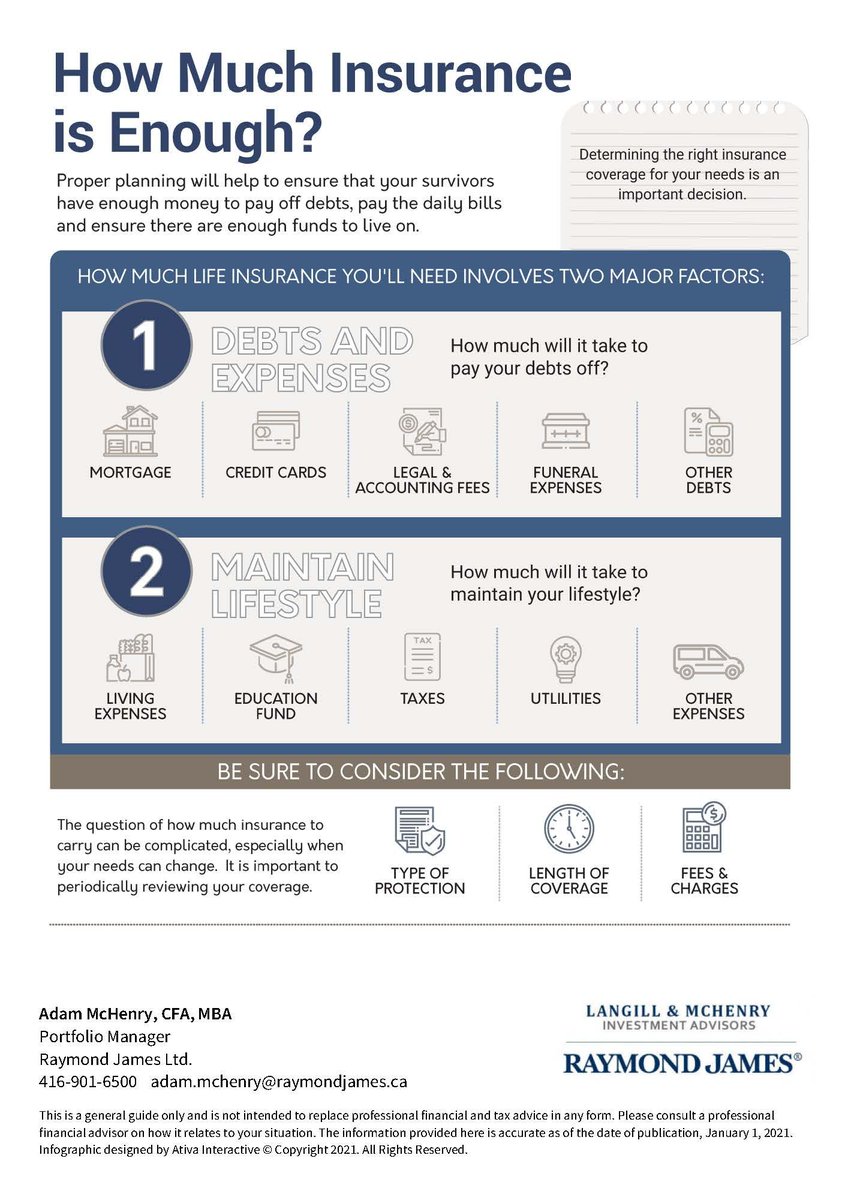

Who cannot deduct funeral expenses. If the estate in question pays federal taxes they may be able to deduct the funeral expenses on a return if the estates funds were used for the funeral costs. Unfortunately funeral expenses are not tax-deductible for individual.

If you prepay with a licensed funeral establishment or transfer service your money is protected by the Prepaid Funeral Services Compensation Fund administered by the Bereavement Authority. For example if you receive financial. This means that you cannot deduct the cost of a funeral from your individual tax returns.

Funeral expenses are generally not tax-deductible unless the deceaseds estate pays for the costs. Unfortunately funeral expenses are not tax-deductible for individual taxpayers. However there are a few exceptions to this rule.

Individual taxpayers cannot deduct funeral expenses on their tax return. The ability to deduct funeral expenses on your tax returns depends on who paid for the funeral expenses. While the IRS allows deductions for medical expenses funeral.

Do Funeral Expenses count as medical expenses. Knowing if your funeral expenses count as a medical expense is essential. Generally funeral expenses are tax deductible if theyre paid out of your own personal funds.

If the beneficiary received the death benefit see line 13000 in the Federal Income Tax. In order for funeral expenses to be deductible you would need to have paid. Up to 10000 of the total of all death benefits paid other than CPP or QPP death benefits is not taxable.

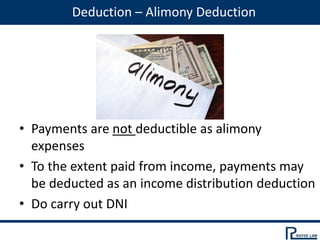

These are considered to be personal expenses of the family members and attendees and funeral expenses are not deductible on personal income tax returns. Unfortunately funeral expenses are not tax-deductible for individual. The short answer to this is no -- funeral expenses are not tax-deductible in the vast majority of cases.

While the IRS allows deductions for medical expenses funeral costs are not included. The ability to deduct funeral expenses on your tax returns depends on who paid for the funeral expenses. You may be able to deduct medical expenses on the deceased persons individual income tax return.

However only estates worth over 1206 million are eligible for these tax. If you file your return by the due date you can receive a tax break of up to 5000. The costs of funeral expenses including embalming cremation casket hearse limousines and floral costs are deductible.

IRS rules dictate that all estates worth more. Funeral Costs as Qualifying Expenses. Although the IRS allows deductions for medical expenses funeral expenses are not included.

If you have an income below.

The Top 10 Tax Benefits Of Investing In Commercial Real Estate Commercial Real Estate Loans

What Is The Difference Between A Disbursement And Distribution Marcia L Campbell Cpa

Life Insurance What Is Is It How Does A Policy Work 2022

How To Deduct Medical Expenses On Your Taxes Smartasset

Is Paying Taxes A Form Of Charity Many Say Yes It Is

Bills Would Offer Tax Relief For Blood Organ Donations Politico

Federal Fiduciary Income Tax Workshop

Are Funeral Expenses Tax Deductible Funeralocity

Can I Write Off Home Office Expenses During The Pandemic Cbs8 Com

Are Funeral Expenses Tax Deductible Youtube

Federal Fiduciary Income Tax Workshop

Death And Taxes Basic Funerals

How To Pay For A Funeral With No Money Funeralocity

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

3 11 106 Estate And Gift Tax Returns Internal Revenue Service